SPESENFUCHS

E-invoicing has been mandatory for companies in Germany since January 1, 2025. This obligation affects the B2B sector in particular and is intended to drive forward the digitalization of accounting. In this context, various e-invoice formats such as ZUGFeRD and XRechnung are becoming increasingly important. A comparison of these formats illustrates their specific features and areas of application.

ZUGFeRD

ZUGFeRD (Zentraler User Guide des Forums elektronische Rechnung Deutschland) combines a PDF/A-3 file with embedded XML data. This hybrid format enables both human readability and automatic processing of invoice data. ZUGFeRD is aimed at companies of all sizes and facilitates the exchange of electronic invoices in the B2B sector.

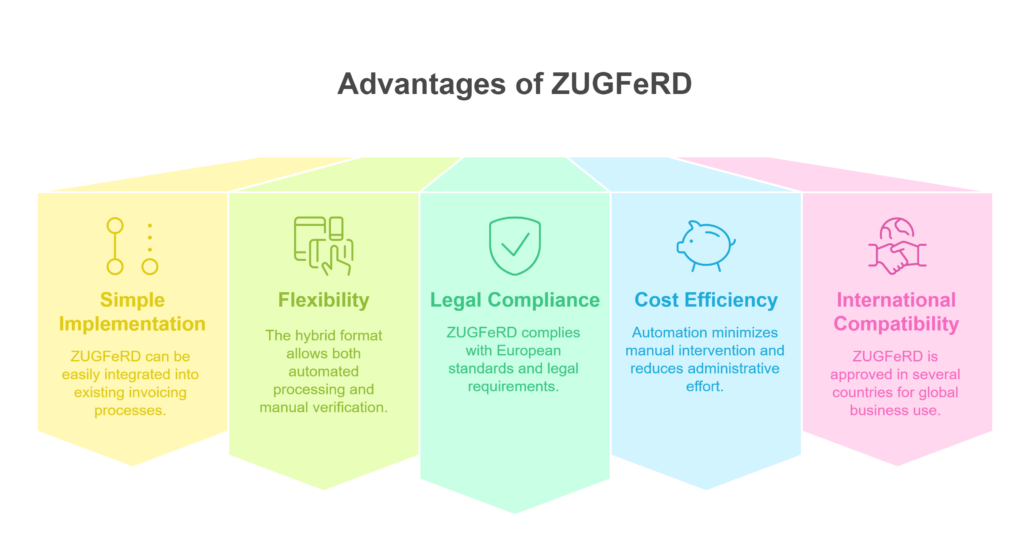

ZUGFeRD offers companies numerous advantages:

- Simple implementation: As ZUGFeRD is based on the widely used PDF, it can be easily integrated into existing invoice processes.

- Flexibility: The hybrid format allows both automated processing and manual checking by the invoice recipient.

- Legal certainty: ZUGFeRD meets the requirements of the European standard EN 16931 and therefore fulfills all tax and legal requirements.

- Cost savings: By automating the invoicing process, manual intervention is minimized, which reduces administrative costs.

- International compatibility: ZUGFeRD is recognized in several countries and can be used in international business relationships without any problems.

Spesenfuchs supports the ZUGFeRD formats from version 2.0.1, which ensures that all legal requirements are met and companies can process their invoices correctly.

Possible pitfalls and solutions

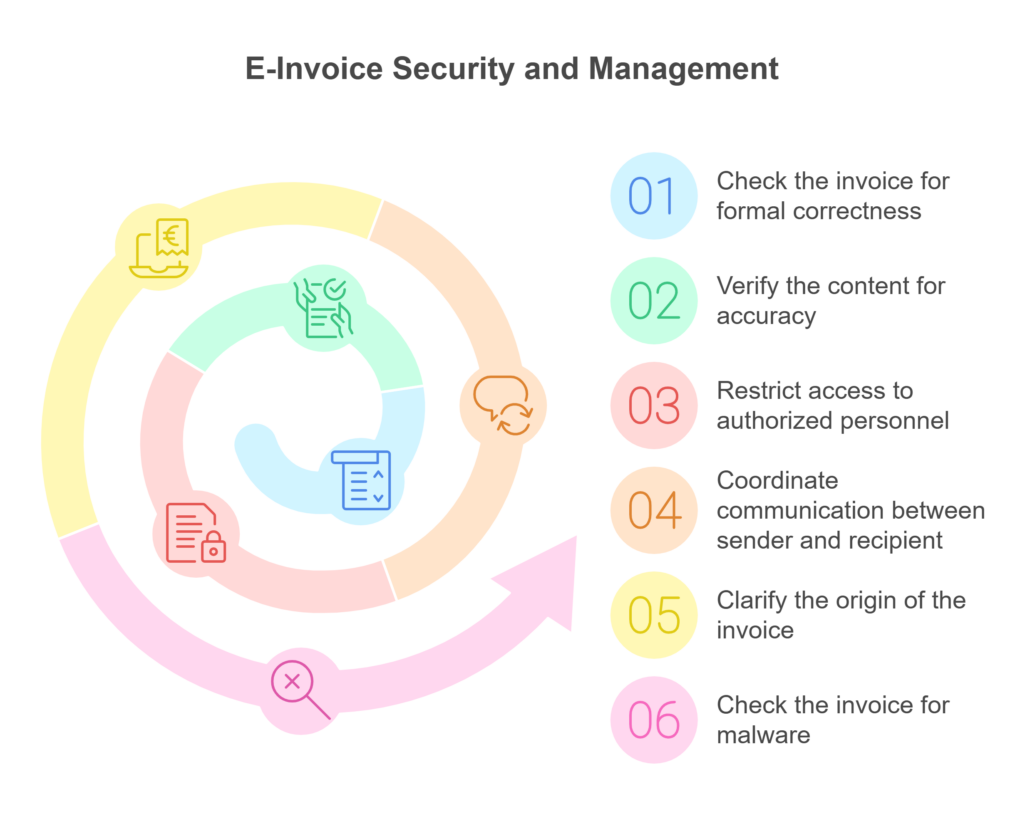

Outdated formats such as ZUGFeRD 1.0, which do not comply with current standards, are particularly problematic. In such cases, companies believe that they have received a compliant invoice. However, input tax deduction is often not possible with these old versions. Incorrect or manipulated XML data also harbors a risk and can lead to financial losses.

What can companies do?

- Have e-invoices validated: It is important to check e-invoices for compliance. Programs such as Spesenfuchs perform this validation automatically and prevent incorrect invoices from being processed.

- Contact the supplier: In the case of incorrect or outdated invoices, the supplier should be contacted and insisted on a correction.

- Build up technical knowledge: Companies should familiarize themselves with the technical requirements of the latest ZUGFeRD formats, such as ZUGFeRD 2.0.1 or XRechnung 3.0. A central component of the e-invoice is the XML document, which contains the machine-readable data. If this is manipulated by fraudsters – for example, by using incorrect IBANs or amounts – and the invoice is released, the amount would be transferred to the wrong account.

- Ask if bank details have changed: If you change your bank details, you should call to make sure that the change is legitimate. Confirmed and known bank details can be saved and compared with new invoices.

- Use spam filters and security protocols: If an email passes the SPF or DKIM test even though it appears suspicious, it can be assumed that the sender domain has been hacked. In such cases, the domain information can be checked and abuse reported.

- Use anti-spam and anti-malware software: Emails should be filtered by anti-spam programs to block potential threats.

XRechnung

XRechnung is a structured, XML-based format that meets the requirements of the European standard EN 16931. It was developed specifically for the exchange of electronic invoices with public clients and has been mandatory for invoices to federal authorities since November 2020. XRechnung only contains machine-readable data and does not have a visual representation.

Comparison of formats

| Feature | XInvoice | ZUGFeRD |

|---|---|---|

| Structure | Pure XML format | Hybrid format: PDF/A-3 with embedded XML |

| Readability | Machine readable only | Human and machine readable |

| Area of application | Mandatory for invoices to public clients | B2B, B2G, suitable for different company sizes |

| Standard | Complies with EN 16931 | Complies with EN 16931 (from version 2.0) |

| Profiles | No subdivision | Different profiles depending on information requirements |

Other formats

Transitional regulation

There is a transitional period for companies that do not yet use e-invoices. Until December 31, 2026, invoices may continue to be sent in paper form or as a PDF, provided the recipient agrees. From 2027, however, electronic invoicing will be mandatory for all companies.

Retention obligation

The retention obligation for e-invoices in Germany is regulated by the German Fiscal Code (AO) and the German Commercial Code (HGB) and corresponds to the same requirements as for paper invoices. E-invoices must be stored for a period of 10 years. The period begins at the end of the calendar year in which the invoice was issued.

When storing electronic invoices, it is important that they are archived in a way that ensures their legibility and immutability over the entire retention period. This means that the invoices must be both legible at all times and protected against changes.

It is also important that e-invoices may not be changed in order to ensure the integrity of the data. Subsequent processing, for example by changing XML data or PDFs, is not permitted by law. If an e-invoice is printed out and stored on paper, the same retention obligations apply to this printout as for other paper documents. Here too, it must be ensured that the data cannot be changed.