SPESENFUCHS

On your business trips you incur expenses for food, accommodation & Co. If you prepare a travel expense report, you can claim your travel expenses and have them reimbursed by your employer or save taxes vis-à-vis the tax office. We explain what travel expenses include and how the travel expense software Spesenfuchs supports you.

The regulations described below are valid as of January 2021. Regulations change over time, usually annually. Therefore, it makes sense to use software for travel expense accounting that always takes into account the current regulations. With an Excel spreadsheet for the settlement of travel expenses, you may be dealing with a lot of extra work if it becomes outdated after a year.

How to create a travel expense report?

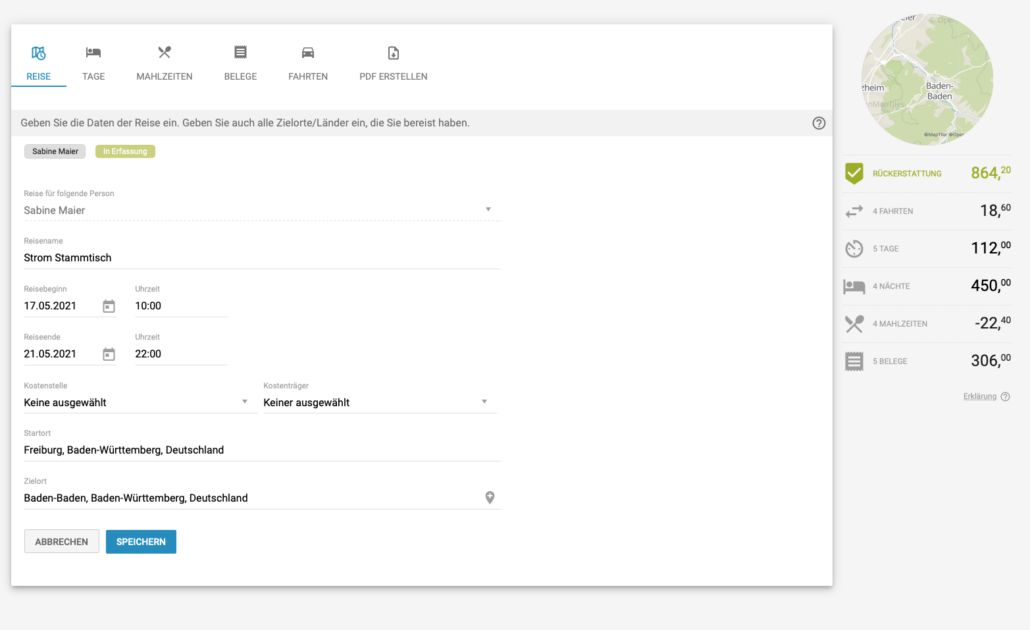

The travel expense software Spesenfuchs helps you to create a proper travel expense report. In this way, you can avoid mistakes that may lead to trouble with the tax office and result in high additional payments. It is important that you first correctly indicate the following items on each travel claim:

- Name of the traveler

- Date

- Duration

- Name of the trip (reason for the trip)

- Destination

A travel expense report usually further consists of the components explained in more detail below:

- Additional expenses for meals

- Accommodation costs (hotel or flat rate)

- Meal Cuts

- Incidental travel expenses (e.g. for flight, cab, etc.)

- Travel expenses

Catering expenses

If you travel on business, you incur meal costs as a result; these are called additional meal expenses. The concept of additional meal expenses comes from the fact that when you are on the road, you have “more expense” for your meals – meals on the road are more expensive than at home. In common parlance, the additional meal expenses are also called per diem, analogous to the following per diem for overnight stays.

In principle, all additional meal expenses are reimbursed to you tax-free. Legislation allows you to receive a certain amount tax-free for each day you travel on business to compensate for the expense of meals on the road. Whether or not you receive this amount from your employer (tax-free) is irrelevant for tax purposes.

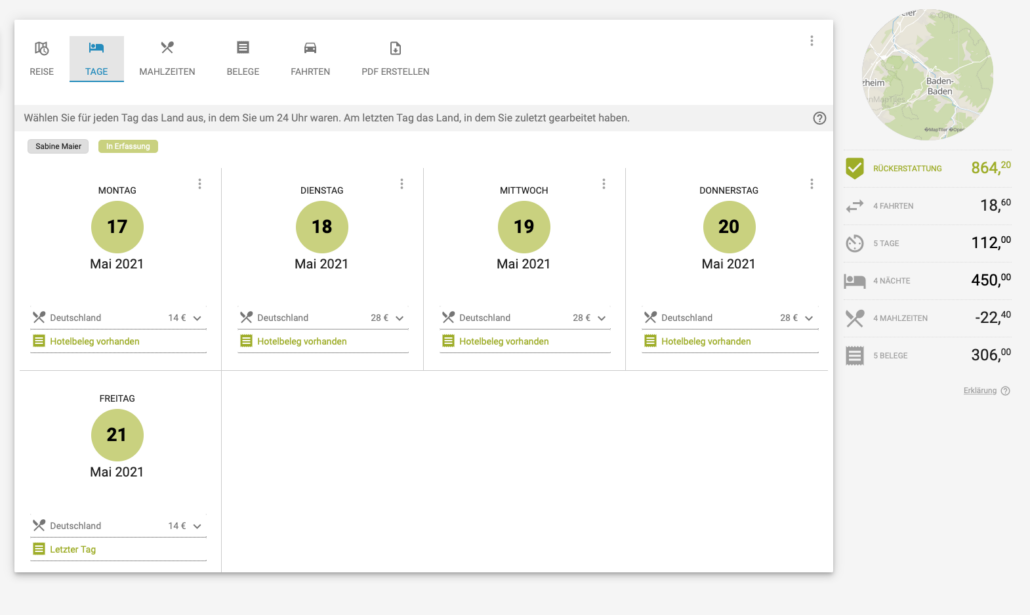

However, according to the statutory travel expense guidelines, the amount of money you receive back or can claim for tax purposes is graded according to the duration of your absence per calendar day. Since the 2014 travel expense reform, there are two flat rates that you can easily enter in your travel expense report for your professional absences within Germany:

The current additional meal expenses for 2021 for Germany are as follows. If a trip includes one day and is shorter than 8h, then no per diem is granted.

| Travel time | Lump sum payment amount |

| min. 8 – 12 hours | 14 € |

| min. 24 hours | 28 € |

Overnight stay flat rate

You have two options with regard to claiming overnight expenses on your trips:

- You use a flat rate in your travel expense report. This amounts to 20 euros per night for Germany (in 2021). You do not need an itemized bill. The travel expense software Spesenfuchs uses the per diems automatically as long as you do not enter a hotel receipt. However, self-employed persons are not allowed to report an overnight allowance.

- You have a hotel voucher. You will receive a reimbursement in the proven amount.

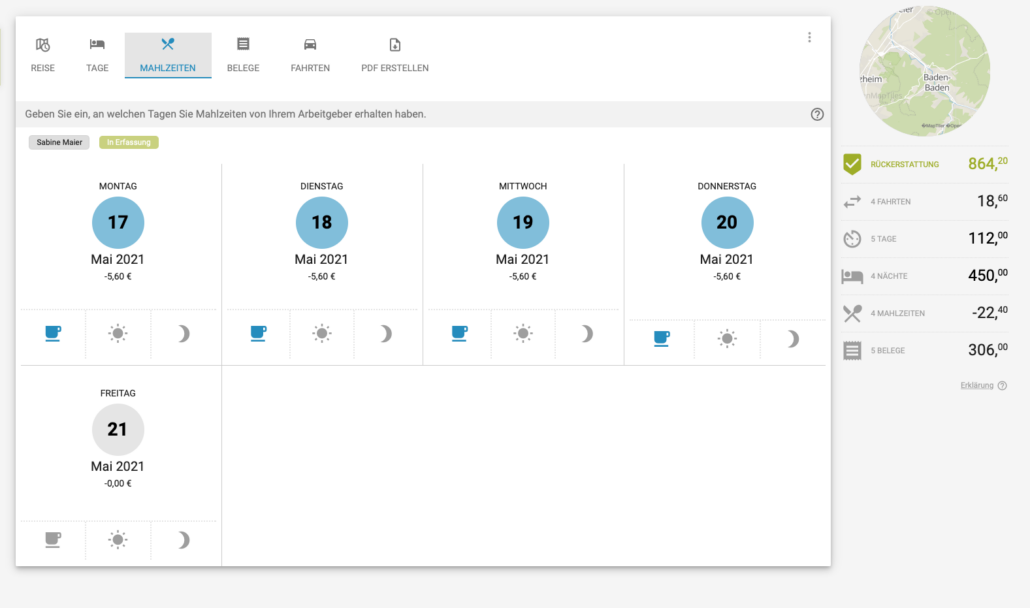

Important: Note that accommodation costs often already include the cost of breakfast. However, breakfast is part of the meals and therefore already included in the flat rates for additional meal expenses. If this happens to you, you will have to deduct an amount for breakfast in your travel expense report. This amount is also called a reduction. The reduction is calculated from the amount of the additional meal expense. It is necessary to deduct 20% of the amount for the absence of 24 hours for the particular country of travel. For Germany, this is currently 5.60 euros per breakfast in 2021.

What regulations apply to travel abroad?

As soon as you travel abroad on business, different amounts apply for travel expense reporting than within Germany. The current rates are published regularly as part of a BMF letter. However, depending on the country of travel (and sometimes also within countries depending on the city), these can vary. The travel expense software Spesenfuchs knows all current per diems and automatically uses the right ones for your destination.

Meal Cuts

Just as for breakfast, if the employer arranges for the employee (or you as a self-employed person arrange for yourself) to have a meal in a professional context, a certain amount must be deducted from the additional meal expenses. This makes sense, since in this case there is no additional expense for catering – the meal was provided. For lunch or dinner, 40% of the daily allowance is deducted for each 24h absence. Thus, in the case of full board, 20% + 40% + 40% are deducted, so that no more per diem for meals is granted – you are also fully boarded.

Special features of travel expense reporting

As you can see, there are a few points to consider when creating a proper travel expense report. But that was not all:

- Not all countries are included in the above list from the BMF. For a number of countries not included in the list, the Luxembourg per diems and per diems must be used. For other countries or regions, different contexts apply due to the countries’ geography or history.

- Non-cash benefit: since the 2014 travel expense reform, there is an important distinction here, which we discuss here.

- Further, there are VAT regulations related to the Corona Pandemic, which will be discussed in this article.

The travel expense software Spesenfuchs takes all these points into account, so that you can be sure to create a legally/tax-compliant travel expense report.

Travel expenses

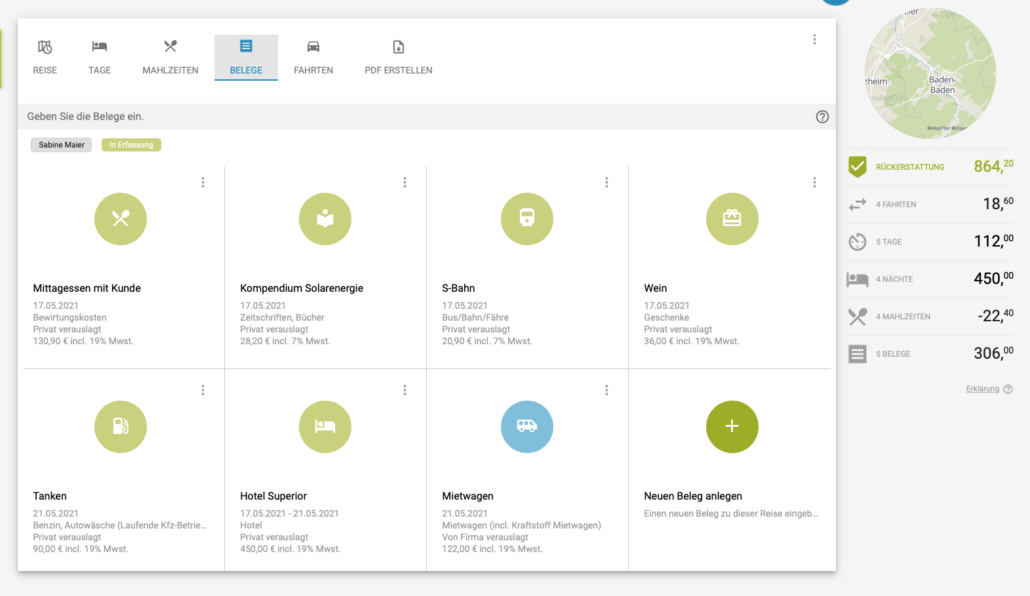

Incidental travel expenses include all other expenses that are additionally incurred in connection with your business trips. In the travel expense software Spesenfuchs you enter all incurred expenses on the Receipts page. The correct tax rates are automatically suggested and, in the case of foreign receipts, a correct conversion is automatically made into euros on the date of the receipt. For example, expenses that you can include in your travel expense report include the following items:

- Entertainment costs

- Gasoline

- Training costs

- Parking fees

- Toll

- Ferry costs

- Baggage fees

- Professional phone calls

- etc.

With few exceptions, you may claim incidental travel expenses in full on your travel expense report. A prerequisite for reimbursement is, of course, that you can provide the appropriate supporting documents. In Spesenfuchs you will never lose a receipt again. Upload the receipt so that you have it available digitally. In this way, the document also goes to your accounting department or to your tax advisor.

Travel expenses

For travel expenses, it depends on how they were incurred:

- Company car

- Private vehicle

- Bus, train or plane

Company car

If you use a company car for your business trips, you only have to keep a proper driver’s logbook or alternatively apply the 1% method for taxation. Otherwise, you do not need to pay attention to anything else here.

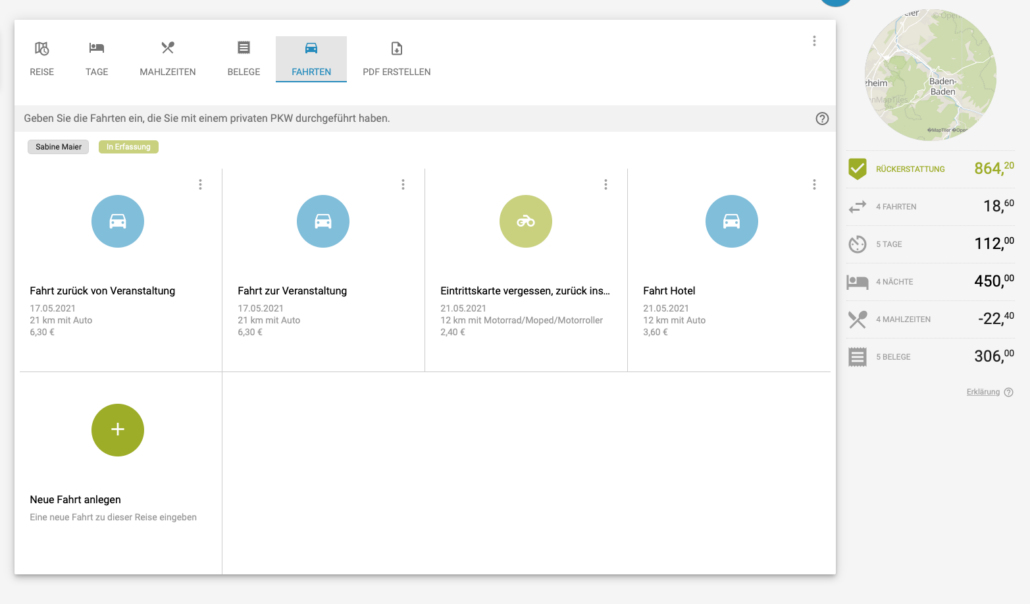

Private vehicle

Things get a bit more complicated as soon as you use a private vehicle for business purposes. Here you have two options for taxation:

Flat mileage rate

For business trips with your private vehicle, you set 0.30 euros per kilometer driven in the travel expense report. This km rate is used automatically by Spesenfuchs.

For business trips by motorcycle or other two-wheeled vehicles, a flat rate of 0.20 euros per kilometer traveled applies.

These rates are tax exempt.

Individual kilometer rate

With the individual mileage rate, all costs related to the vehicle can be taken into account. All costs, such as depreciation, gasoline, insurance, are added up and then divided between the kilometers driven privately and those driven on business. A driver’s logbook should be kept as proof of the kilometers driven for private or business purposes.

If you want to apply an individual mileage rate, then you can store an individual rate for each employee in Spesenfuchs.

Any amounts in excess of the flat mileage rate must be taxed at the employee’s individual tax rate.

In the reports and In export, the amounts for tax-free and taxable mileage allowances are output correctly.

Bus, train or plane

If you travel on business by bus, train or plane, you can deduct the travel expenses incurred in full from your taxes. All you need here for your travel expense report is a corresponding receipt.