SPESENFUCHS

You’ve been to the restaurant, had a good time and now you have to suffer because you don’t know how to account for that receipt correctly? You can rest assured, below we will explain in great detail how to correctly enter a hospitality receipt.

First of all, it comes down to making sure that you get a proper hospitality receipt while you are still at the restaurant. The BMF has commented on the requirements for a hospitality receipt.

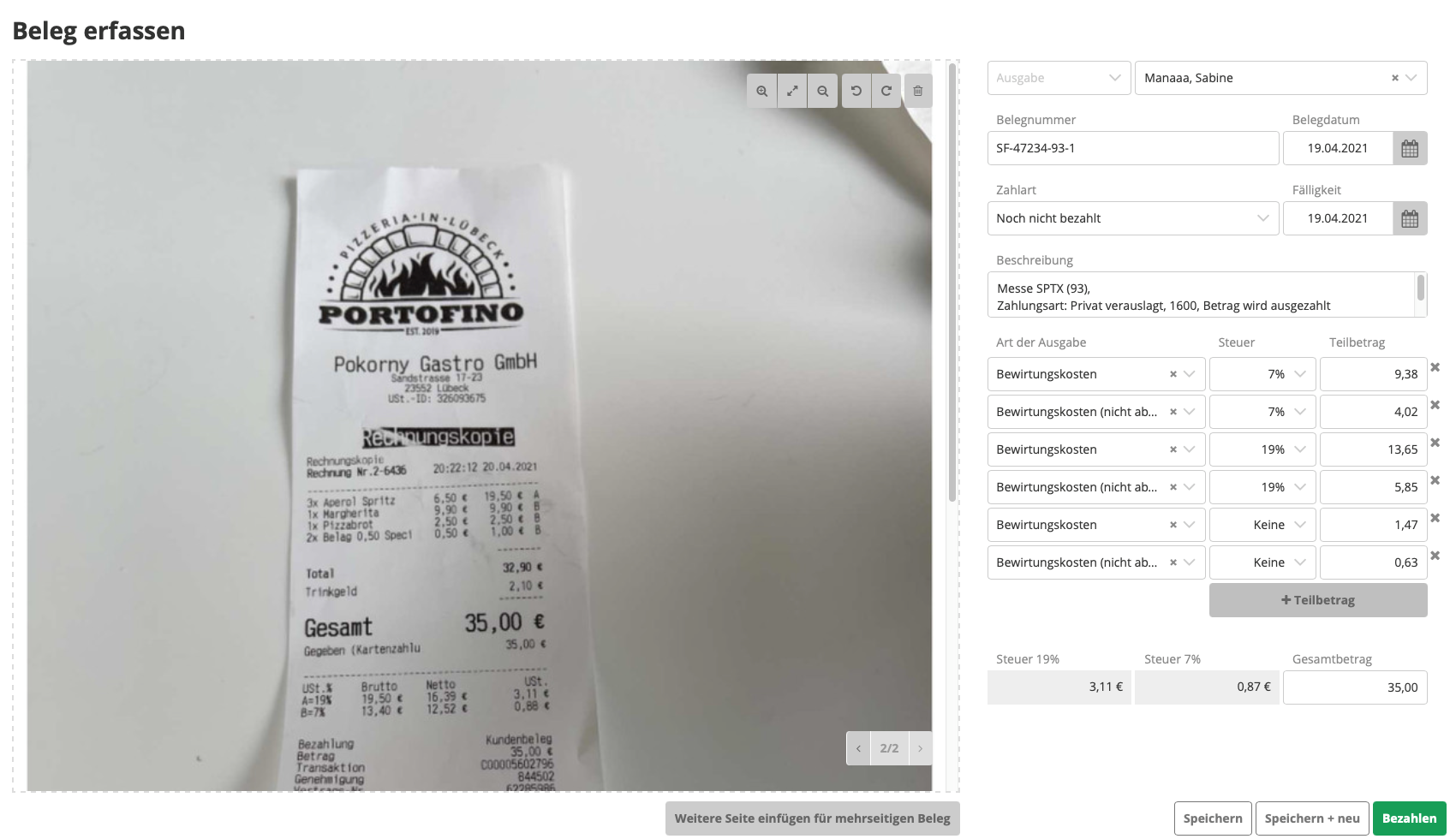

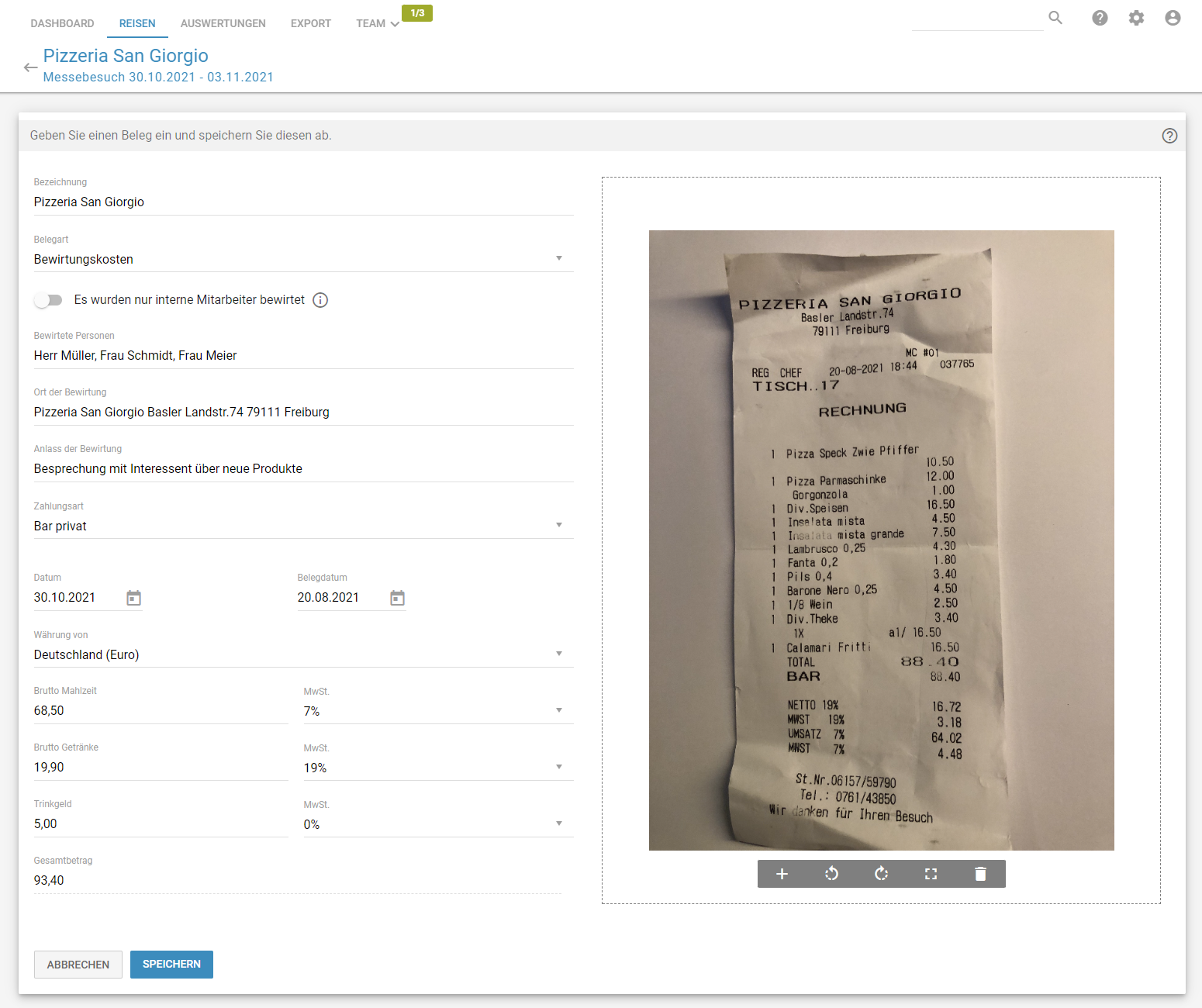

Now you are sitting in front of your Accounting with this receipt and don’t quite know how to book it? Create an account with Spesenfuchs and everything will actually happen automatically:

- The document is automatically recognized via OCR

- Spesenfuchs creates a receipt with the individual amounts for the meal, drinks and tip.

- Alternatively, if you do not want to use OCR or it does not fully recognize the receipt, enter the values for the meal, drinks, and tip.

- The separation between meal and beverages is necessary because of the different VAT. Here more about this.

- Your work is now done. Spesenfuchs automatically generates the correct accounting records and transfers them via interface to various accounting systems such as lexoffice, sevDesk, Kontolino or DATEV.

We will now explain how these postings look in detail, even if you do not use Spesenfuchs:

Each of the 3 amounts is divided into a 70% and a 30% portion, since only 70% of the expenses are deductible for business entertainment. The remaining 30% is not deductible and must therefore be posted to another account. This results in 3 times 2 bookings:

| Designation | VAT | SKR03 | SKR04 |

|---|---|---|---|

| Meal 70% deductible | Reduces | 4650 | 6640 |

| Meal 30% not deductible | Reduces | 4654 | 6644 |

| Beverages 70% deductible | Full | 4650 | 6640 |

| Beverages 30% not deductible | Full | 4654 | 6640 |

| Tip 70% deductible | without | 4650 | 6640 |

| Tip 30% not deductible | without | 4654 | 6644 |

We are talking here about so-called “business” hospitality. Business entertainment is when outside persons participated in the entertainment such as customers, contractors, etc.

Another case is the so-called “company” hospitality. This is the case if only employees participated in the hospitality. In this case, the costs are posted as follows.

| Designation | VAT | SKR03 | SKR04 |

|---|---|---|---|

| Meal | Reduces | 4140 | 6130 |

| Drinks | Full | 4140 | 6130 |

| Tip | without | 4140 | 6130 |

All this is done automatically in Spesenfuchs, as you can also specify whether it was a business or company entertainment when entering an entertainment receipt.

In the various accounting solutions, the automatically generated entries then look like this:

Please note that in the case of large amounts or business entertainment with the entrepreneur, further regulations may apply, which Spesenfuchs does not depict. Apart from that, the described is one of the features where Spesenfuchs differs from most other software solutions.