SPESENFUCHS

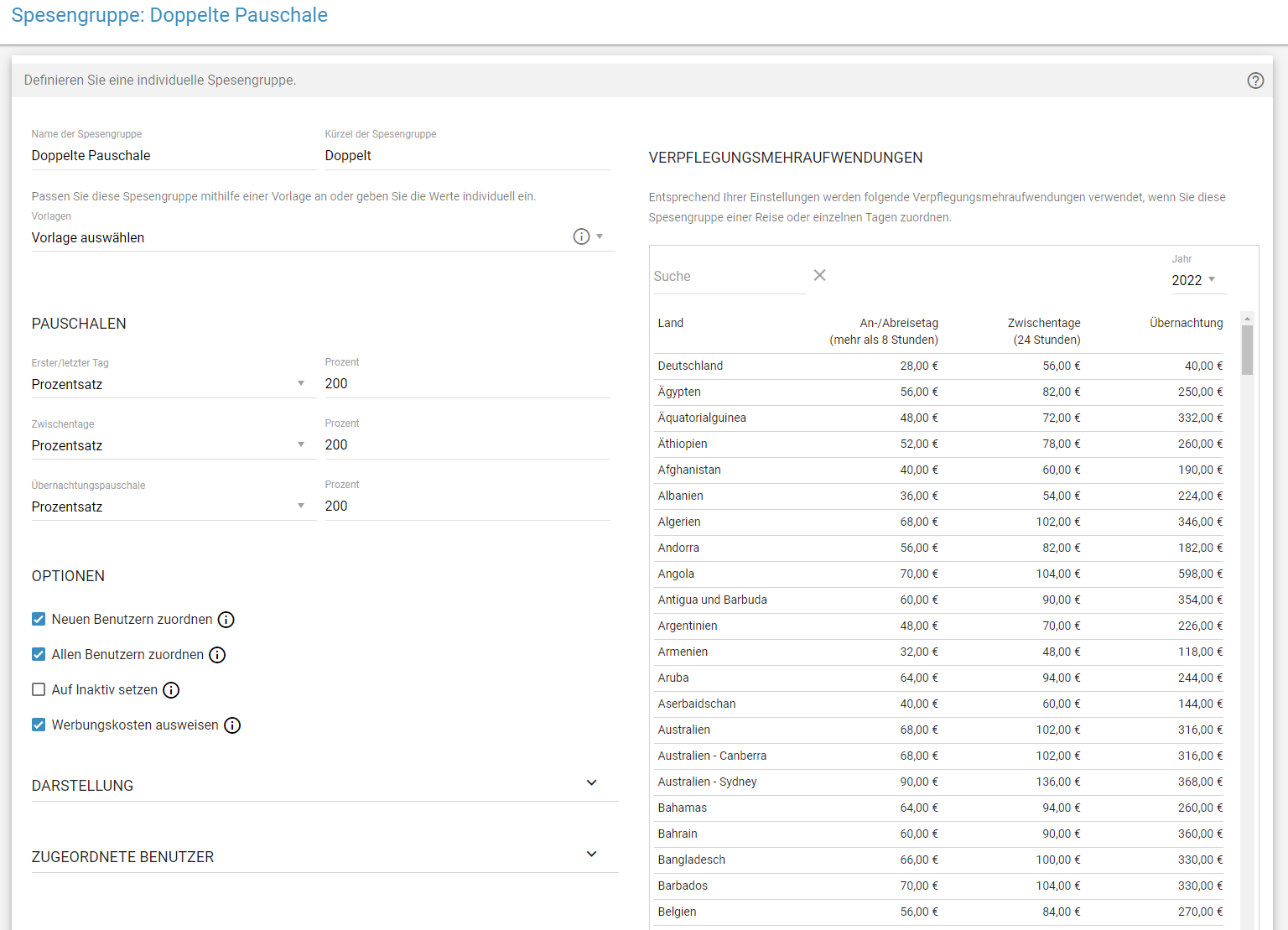

In principle, the legislator specifies flat-rate amounts that are exempt from tax for each country to which you travel on business. However, you and your employees can also benefit from the travel expense report for tax purposes, because up to twice the amount, the per diems for meals are only taxable at 25%.

Define as many expense groups as you like to organise your individual per diems. For example, you can define an expense group for trade fairs or assembly or create expense groups for specific groups of people. This allows you to easily manage individual flat rates for management or sales, for example.

Spesenfuchs can increase or decrease the statutory flat rate on a percentage basis according to your wishes. An increase of the statutory flat rate by a fixed amount is possible as well as a fixed amount independent of the countries travelled.

If you want to grant less than the statutory flat rates or no flat rates, you can also set this in the expense groups. Here, another useful function allows you to show the income-related expenses. This allows your employees to claim the per diem meal allowance on their tax return without having to make any further calculations.

In some cases, it may make sense for you to bill individual days with another group of expenses and thus other flat rates, rather than the whole trip with one group of expenses. Spesenfuchs also offers a solution here, as you can choose one of the two models – one expense group per trip or selectable for the individual days of the trip.

And no matter how you configure your expense groups, Spesenfuchs ensures that the correct amounts and taxes end up in your accounting or payroll.