SPESENFUCHS

For work-related travel in a private vehicle during a business trip, € 0.30 per kilometre can be claimed via the kilometre allowance without having to prove individual costs to the tax office. Other motor-driven vehicles may be charged at a flat rate of 0.20 €/km. Unfortunately, cyclists are still left empty-handed.

Previously, the flat rate could be increased if passengers were taken along. This regulation has been dropped.

With Spesenfuchs, you don’t need to invest any effort in researching the current legal regulations. Simply enter your rides, Spesenfuchs will calculate the amounts for you and output them on the appropriate reports and exports.

You can also charge for kilometers driven by car with individual km rates. To do this, simply store the individual km rate for each user. Spesenfuchs calculates the amounts for you and additionally outputs the taxable amounts in the reports.

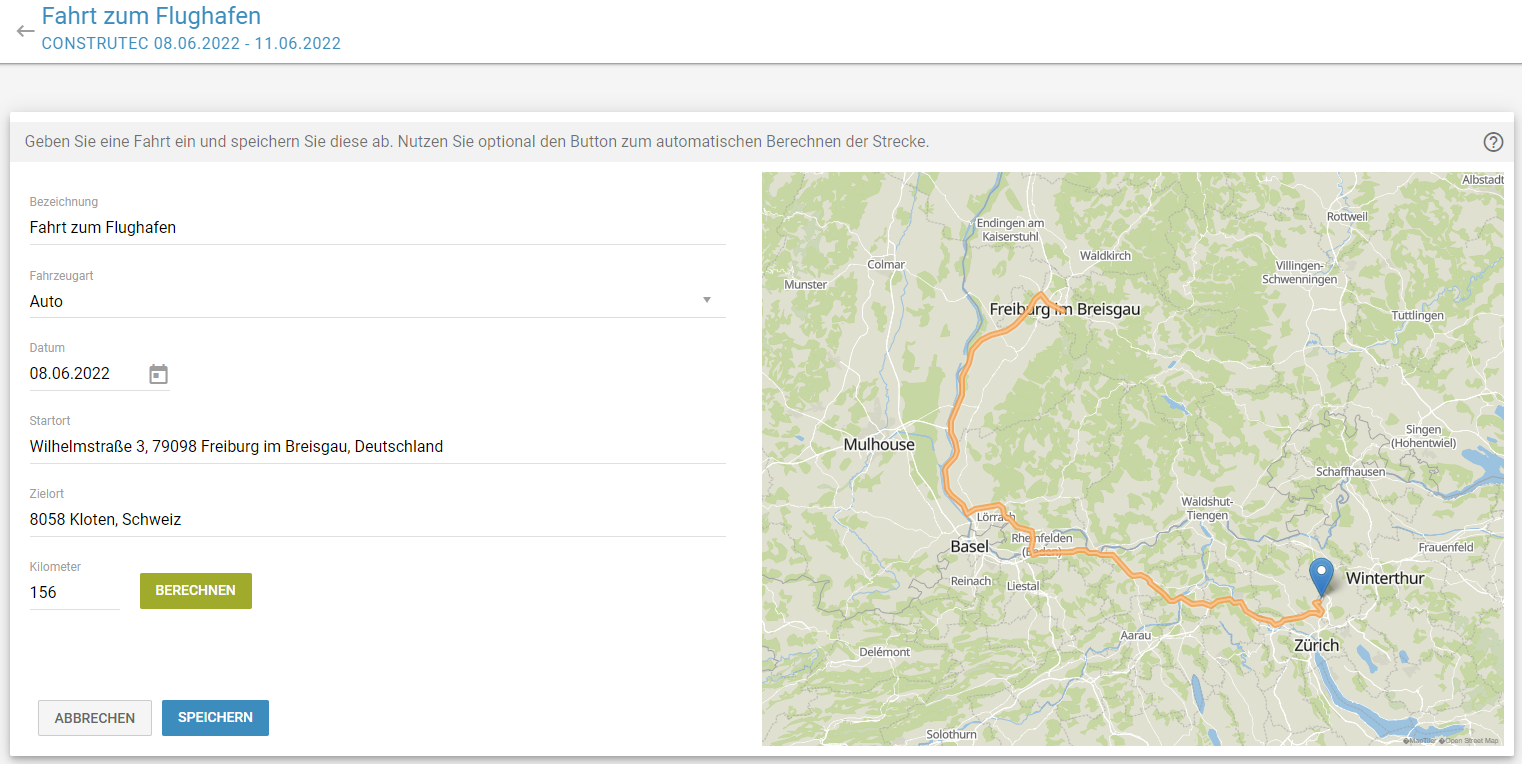

Spesenfuchs calculates your driven kilometers automatically. You only enter the start and destination of a ride and the route is displayed on a clear map. You also drove the same route back? Then additionally enter the date of the return journey. With one click, the route is calculated and the kilometers driven are transferred to your travel expense report.