SPESENFUCHS

The changes in detail:

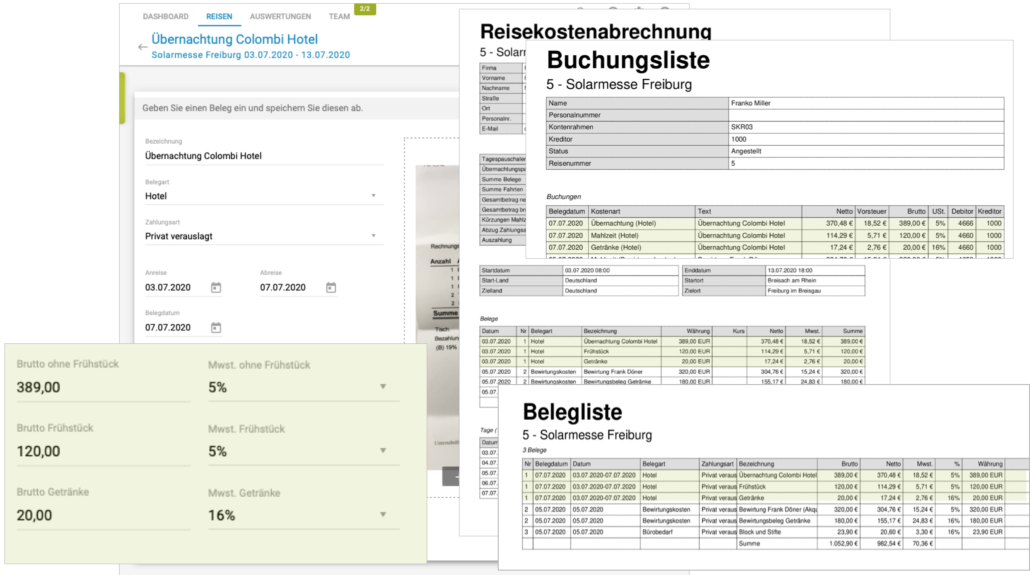

- Hospitality receipts will have a second field for an additional amount for beverages if the hospitality is for the period 7/1/2020 – 12/31/2023 in Germany. This way, you can continue to enter hospitality in one step and not have to split the receipt. The reduced VAT rate valid on the voucher date is offered in the field for the meal, and the full VAT rate valid on the voucher date is preset in the field for the beverages.

- Spesenfuchs also offers a third field for beverages in hotel receipts, even in the case of an overnight stay in Germany with breakfast in the period 7/1/2020 – 12/31/2023. So, even in the case of a hotel stay with breakfast, you do not need to make a split of receipts for drinks and breakfast, but you can specify all data in one receipt.

In the reports, all data are output correctly accordingly.